Describe How the Valuation Principle Is Used by Financial Managers

Your estimate of cash flows not only measures the size but. Concentration on Wealth Maximization.

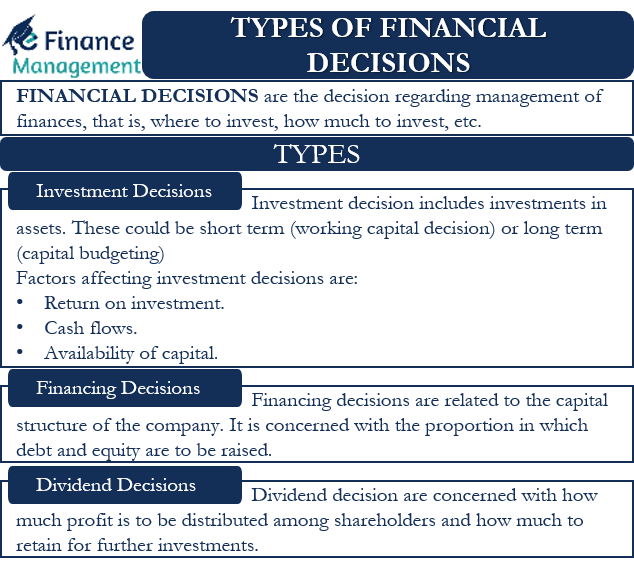

Financial Decisions Meaning Important Financial Decisions

Why can there only be one competitive price for a good.

. Perhaps you purchased a piece of. Take a look at your companys income statement and note the direct expenses related to the revenue for that period. Core principles of finance are applicable in the case of principles of financial management.

Describe the role costs and benefits play in the valuation principle. The Value of the firm is the total value of all individual assets deployed in the company. Total Asset Turnover Revenue Beginning Total Assets Ending Total Assets 2 10.

The steps should be realistic but also give a person or a business something to strive for in the future. The value of an asset is the present value of its expected returns. Aware of Time Value of Money.

It provides a basis for making decisions within a company. Describe the role costs. Trade-off Risk and Return.

Time Value of Money. It is the job of the financial manager to break the idea down into detail to analyze the benefits and the costs and then make a decision based on concrete numbers. 6 Ways Managers Can Use Financial Statements.

This is what got Enron into trouble. Both the Principles and. By gaining a comprehensive understanding of financial analysis and valuation executives and other professionals will be able to better assess the financial implications of investments and other business activities and make decisions that create greater value.

PRINCIPLES AND PRACTICES OF FINANCIAL MANAGEMENT 5 12IFFERENCE BETWEEN PRINCIPLES AND D PRACTICES This document has two core elements. Describe how the Valuation Principle is used by financial managers. Setting a goal gives an incentive for.

The five principles are consistency timeliness justification documentation and certification. The CEO and CFO were basing revenues and asset values on opinions and guesses it turned out. Take advantage of the time value of money.

Uses of Value Additivity Principle Valuation of Firm. As a manager its important to have a method for tracking the impact your efforts have on your companys bottom line. -The value of a commodity or an asset to the firm or its investors is determined by its competitive market price.

-When the value of the benefits exceeds the value of the costs the decision will increase the market value of the firm. Particularly in order to make their relevant decisions. F or a financial manager evaluating financial decisions involves computing the net present value of a projects future cash flows.

The objectivity principle is the concept that the financial statements of an organization are based on solid evidence. Describe how the Valuation Principle is used by financial managers. Valuation of the company or its assets is significant for a financial manager.

A The Principles describe the Societys aims and objectives in the management of the With Profits Fund and are designed to be long-term in nature. Diversification of both Investment and Borrowing. Up to 5 cash back Learn about the 10 principles of money management and youll be on your way to personal savings like never before.

Sound financial principles begin with goal setting saving money and patiently working toward growing an investment. You must discount the earnings stream at your required rate of return by estimating the cash flows and your rate. Do some research and define and describe the valuation principle.

Do some research and define and describe the valuation principle. Policies and procedures within Research Accounting Services have been developed in support of these principles. Valuation Principle is the one unifying principle that underlies all of finance and links all of the ideas throughout this book.

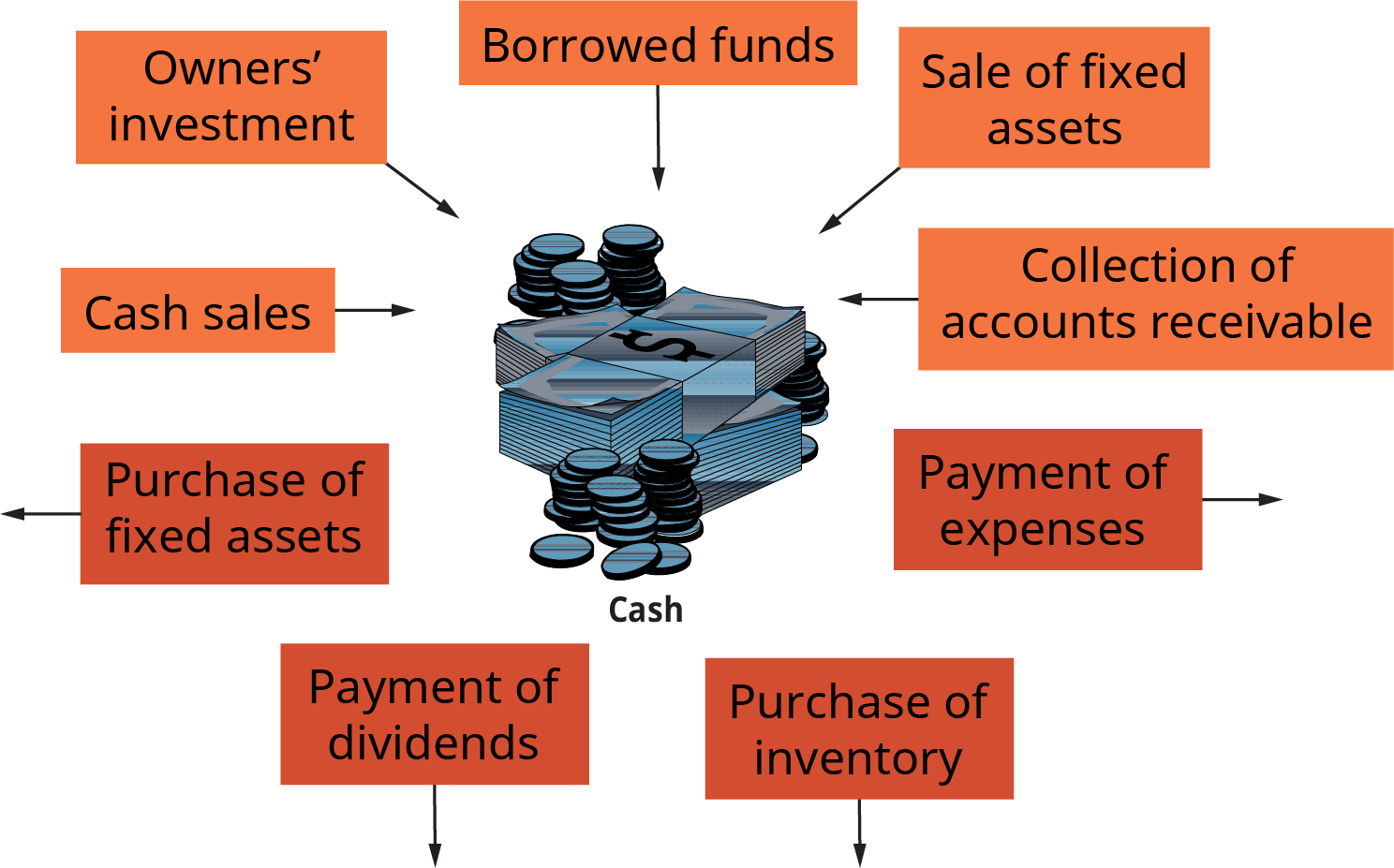

The value of 1 of the present time is more than the value of 1 after some time or years. As such an accurate valuation especially of privately owned companies largely depends on the reliability of the firms historic financial. These assets help in generating cash which further helps to repay Equity holders and Debt holders.

There are five overall principles to managing the financial transactions of sponsored research funds. Financial management can be very beneficial to couples looking to start a family. Issue costs and hedges.

Be sure to cite your source in APA forma. A 21-year-old who invests 1750 a day until retiring at the age of 65 at a 5 percent average annual investment return can be a millionaire. Valuation is a quantitative process of determining the fair value of an asset or a firm.

As he is primarily concerned to increase the value of the company and its shareholders. This principle is concerned with the value of money that value of money is decreased when time passes. The higher the turnover ratio the better the performance of the company.

Take a Right Insurance Plan. The auditors were not objective in their assessment of the financial statements presumably. In finance valuation is the process of estimating what something is worth.

Morris gives the following example. Besides this the creditors and investors are also concerned with the valuation of the company. Describe the role costs and benefits play in the valuation principle.

Valuation often relies on fundamental analysis of financial statements of the project business or firm using tools such as discounted cash flow or net present value. We use the Valuation Principles Law of One Price to derive a central concept in financial economicsthe time value of money. Today valuation is the financial analytical skill that general managers want to learn and master more than any other.

Describe how the Valuation Principle is used by financial managers. 1 More generally APV relies on. Do some research and define and describe the valuation principle.

Formation of Optimal Capital Structure. In general a company can be valued on its own on an absolute basis or else on a relative basis compared. Total asset turnover is an efficiency ratio that measures how efficiently a company uses its assets to generate revenue.

This process is known as the Valuation Principle an analysis between the value of the benefits and the value of its costs. The price determines the value of a good. Be sure to cite your source in APA format.

The Value Additivity Principle is often used to compute the value of the firm.

The Role Of Finance And The Financial Manager Introduction To Business

It Financial Management The Business Of It Define Service Based It Financial Management Activities Informit

Scope And Objectives Of Financial Management

Valuation The Essence Of Corporate Finance Visual Ly Finance Infographic Business Valuation Trade Finance

Comments

Post a Comment